|

|

|

|

| 03-04-2012, 10:19 PM | #45 | |

|

Breakfast at Tiffany's

24

Rep 1,053

Posts |

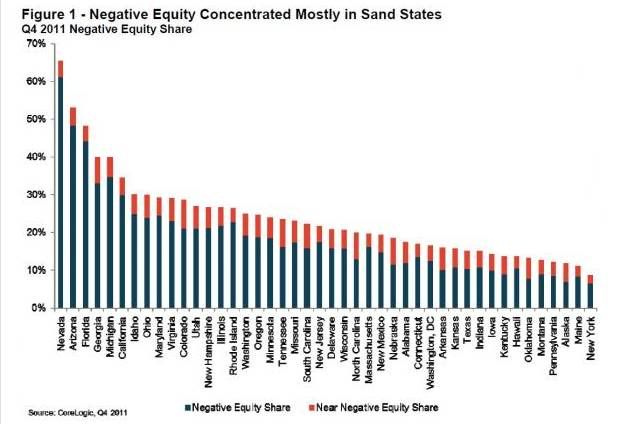

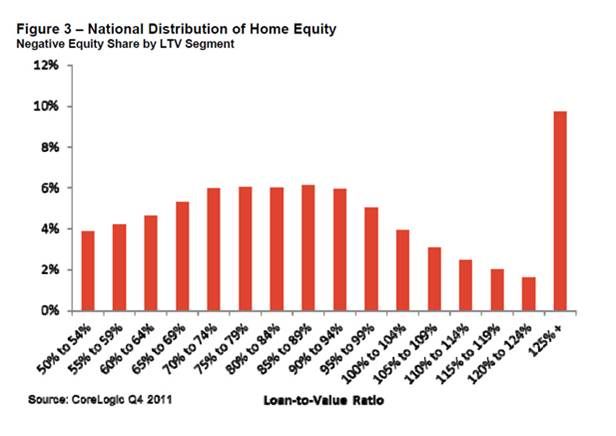

Quote:

There's still a long way to go, prices aren't on the up IMO. There are simply too many houses to get through and not enough people with the funds to pay for them. Prices are forecast to decline 4% this year and by a further 1% next. We never bought a place there as geographically its miles away, you can't check in on it so are at the mercy of rental agency and there are better opportunities locally.    - Nevada had the highest negative equity percentage with 61 percent of all of its mortgaged properties underwater, followed by Arizona (48 percent), Florida (44 percent), Michigan (35 percent) and Georgia (33 percent). This is the second consecutive quarter that Georgia was in the top five, surpassing California (30 percent) which previously had been in the top five since tracking began in 2009. The top five states combined have an average negative equity share of 44.3 percent, while the remaining states have a combined average negative equity share of 15.3 percent. - Of the 11.1 million upside-down borrowers, there are 6.7 million first liens without home equity loans. This group of borrowers has an average mortgage balance of$219,000 and is underwater by an average of $51,000 or an LTV ratio of 130 percent. For all first-lien-only borrowers negative equity share was 18 percent, while 41 percent of all first-lien-only borrowers had 80 percent LTV or higher. - The remaining 4.4 million upside-down borrowers had both first and second liens. Their average mortgage balance was $306,000 and they were upside down by anaverage of $84,000 or a combined LTV of 138 percent. The negative equity share for all first-lien borrowers with home equity loans was 39 percent, more than twice the share for all first-lien-only borrowers. Over 60 percent of borrowers with first liens and home equity loans had combined LTVs of 80 percent or higher. - Nearly 18 million borrowers were between 80 percent and 125 percent LTV and, purely from an LTV perspective, eligible for HARP 1.0. The removal of the 125 percent LTV cap via HARP 2.0 means that over 22 million borrowers are currently eligible for HARP 2.0 when just considering LTV alone. - The low end of the market is where the bulk of the negative equity is concentrated. For example, for low-to-mid value homes valued at less than $200,000, the negative equity share is 54 percent for borrowers with home equity loans, over twice the 26 percent for borrowers without home equity loans. - Of the total $717 billion in aggregate negative equity, first liens without home equity loans accounted for $342 billion aggregate negative equity, while first liens with home equity loans accounted for $375 billion. Over $230 billion in negative equity is from homes valued at $200,000 or less. There were 8.8 million negative-equity conventional loans with an average balance of $269,000 that are underwater by an average of $70,000. There were 1.7 million underwater FHA loans with an average balance of $169,000 that are underwater by an average of $26,000. Source |

|

|

Appreciate

0

|

| 03-04-2012, 10:34 PM | #46 |

|

Captain

28

Rep 771

Posts |

Awesome thread - Im really surprised most people here prefer property>shares. In reality theres no "one best way" to make money, really whatever you're comfortable with. But guys remember theres a difference between trading and investing for shares...

So who here actually "trades" shares rather than invest? - for those people unfortunately we have yet to break the 4300 physiological barrier! any thoughts? |

|

Appreciate

0

|

| 03-04-2012, 10:44 PM | #47 |

|

Banned

88

Rep 3,070

Posts

Drives: A boring one...

Join Date: Oct 2008

Location: Australia

|

Used to trade, but it took too much time and now that I have a business to run it just can't work.

|

|

Appreciate

0

|

| 03-04-2012, 10:54 PM | #48 | |

|

Lieutenant Colonel

51

Rep 1,792

Posts |

Quote:

I do know that he bought in a fairly 'decent' area. They are all rented now and controlled by the agency - I don't think he has ever visited them. He lived in Washington for a while and studied in Ohio - I think he had some good first hand information on the places he bought. I think the gains are modest, but he is happy with the rental income which are 'greater than his savings account'. |

|

|

Appreciate

0

|

| 03-04-2012, 11:16 PM | #49 | ||

|

Breakfast at Tiffany's

24

Rep 1,053

Posts |

Good reading for global risk perspective

Quote:

As a "trader" the tax kills you. It is classes as business income (read the ATO and your accountant) treat your trading as the balance sheet of a business and tax you on turnover and opening/closing balance each year from memory. But you don't get taxed at the 30% rate. It doesn't take much turnover to be over $180k per year. I spoke briefly with my accountant and resolved not to have a day/short term trading account in my name. I never looked into it that far as you can get killed by market sentiment or short term fluctuations. So hypothetically you would never trade or own shares in your own name. You then loose the ability for the 50% CGT discount though, what you save one way they get you another. Quote:

Last edited by 1q2w3e4r; 03-04-2012 at 11:39 PM.. |

||

|

Appreciate

0

|

| 03-04-2012, 11:19 PM | #50 | |

|

Major

108

Rep 1,075

Posts |

Quote:

|

|

|

Appreciate

0

|

| 03-05-2012, 12:37 AM | #51 | |

|

Brigadier General

191

Rep 4,848

Posts |

Quote:

. In fact, you can actually have it in your name, provided you are a trustee of trust . In fact, you can actually have it in your name, provided you are a trustee of trust  . .

__________________

Macan S Diesel - Carrera White

Macan Turbo - White 1///M - Valencia Orange |

|

|

Appreciate

0

|

| 03-05-2012, 12:51 AM | #53 |

|

Brigadier General

191

Rep 4,848

Posts |

Thanks for starting the thread

. .Diversifying is overrated, although it have a place in most portfolio. If you found day trading too time consuming, just swing trade. It takes a lot less time. I tried to get back in to day trade last month, which was a bit difficult as I tried to look after the business at the same time - not good. If someone know of a trading platform in HKE with sophisticated trading tools let me know. My current platform doesn't do stop loss on instruments.

__________________

Macan S Diesel - Carrera White

Macan Turbo - White 1///M - Valencia Orange |

|

Appreciate

0

|

| 03-05-2012, 01:13 AM | #54 |

|

///Mbassador

26

Rep 1,069

Posts |

It's not too difficult to make 20% with options trading. If you do it the safe way then you only sell calls in stock you own and only sell puts in stock you are prepared to take up. The current sideways market with sporadic volatility has been good for band trading. If you own the stock you can pick up dividends, cap gains and option premium = 20%. ( Around 15% after tax ). You have to be prepared to accept losses if you need to buy back an option but overall it's not that hard. DON'T BE GREEDY. Little bits at a time, patience and a realistic understanding of your abilities and investing psyche, i.e. risk tolerance.

With property - for me it's 5 klm radius from a major centre. Look for big work force pools such as say Dutton Park / Highgate Hill in Brisbane. 3 klms from CBD, two major hospitals and Uni Qld. Rail, bus and schools all around, ( incl well regarded Brisbane High ). Buy unit blocks to spread tenant risk and again be patient. The short term yield on quality property isn't great but over time it will overtake the low initial cost / higher yield lower quality property. However, it's hard to beat the reurns from a well run business. If you use a minimum year in year out NET return of 15% pa ( after you pay yourself ) you will get your money back in 5 years. Anything better is icing on the cake. You can get some very nice icing by buying a business that is in need of good management and taking it up a level or two, sell it and do it again. I can hear people scoffing at 15% but I wonder what they have been through? Sure you can have periods of high profit but do it every year.... for decades. Overall, 15% net is not too bad ( again, after you pay yourself. Very important. ) . My 2cw from REAL LIFE experience. |

|

Appreciate

0

|

| 03-05-2012, 01:32 AM | #55 | |

|

Lieutenant Colonel

51

Rep 1,792

Posts |

Quote:

This is essentially what we do now. I decided a while ago trading is not for me. But I really enjoy my business and what we do. We pay ourselves okay and have a lot of fun. |

|

|

Appreciate

0

|

| 03-05-2012, 01:35 AM | #56 |

|

Breakfast at Tiffany's

24

Rep 1,053

Posts |

Yep agree on the above, the only time I would ever pull profits out of the company (via dividends, capital payment etc) is when I could beat the return externally.

|

|

Appreciate

0

|

| 03-05-2012, 02:01 AM | #57 |

|

Lieutenant Colonel

51

Rep 1,792

Posts |

For me, beating the return externally = company is owned by your own trust which you can then redistribute/reinvest.

|

|

Appreciate

0

|

| 03-05-2012, 03:07 AM | #58 |

|

Captain

87

Rep 886

Posts |

A trust is NOT a separate legal entity, it is very different to the corporate vehicle and is used under different circumstances.

|

|

Appreciate

0

|

| 03-05-2012, 05:27 AM | #60 | |

|

Colonel

122

Rep 2,695

Posts |

Quote:

Since you're referring to comments I made: In the other thread Richard was talking about a situation where he owns property already. It wasn't a thread where Richard was asking about an overall investment strategy. My comments were on that basis. People who make money by charging for investment advice are motivated to offer investment advice that results in the need for ongoing investment advice.

__________________

.-=[ Kenny ]=-. 1999 BMW M Coupe 10.775 @ 134.35 mph w/1.600 60' (Best 136.07 mph) 25th August 2004. +2010 X5 35D+

Check out the 1Addicts Drag Racing Standings and Drag Racing 101. |

|

|

Appreciate

0

|

| 03-05-2012, 05:32 AM | #61 | |

|

Colonel

122

Rep 2,695

Posts |

Quote:

Adrian I'm surprised to hear you bought a property in Sydney in 2004 and 8 years later you've valued it at a loss! This is a good point though: there are no sure things in investment. I'd be interested to know the numbers comparing different investment strategies over say ten year periods in the last say 40 years. I know there are members here who are very clued in on various investment channels.

__________________

.-=[ Kenny ]=-. 1999 BMW M Coupe 10.775 @ 134.35 mph w/1.600 60' (Best 136.07 mph) 25th August 2004. +2010 X5 35D+

Check out the 1Addicts Drag Racing Standings and Drag Racing 101. |

|

|

Appreciate

0

|

| 03-05-2012, 05:35 AM | #62 |

|

Colonel

122

Rep 2,695

Posts |

You'll have to explain that one to me in reference to what I posted.

__________________

.-=[ Kenny ]=-. 1999 BMW M Coupe 10.775 @ 134.35 mph w/1.600 60' (Best 136.07 mph) 25th August 2004. +2010 X5 35D+

Check out the 1Addicts Drag Racing Standings and Drag Racing 101. |

|

Appreciate

0

|

| 03-05-2012, 05:38 AM | #63 | |

|

Colonel

122

Rep 2,695

Posts |

Quote:

__________________

.-=[ Kenny ]=-. 1999 BMW M Coupe 10.775 @ 134.35 mph w/1.600 60' (Best 136.07 mph) 25th August 2004. +2010 X5 35D+

Check out the 1Addicts Drag Racing Standings and Drag Racing 101. |

|

|

Appreciate

0

|

| 03-05-2012, 05:46 AM | #64 |

|

Colonel

122

Rep 2,695

Posts |

Same. But I have friends in Australia and in the USA that have had great success trading.

__________________

.-=[ Kenny ]=-. 1999 BMW M Coupe 10.775 @ 134.35 mph w/1.600 60' (Best 136.07 mph) 25th August 2004. +2010 X5 35D+

Check out the 1Addicts Drag Racing Standings and Drag Racing 101. |

|

Appreciate

0

|

| 03-05-2012, 05:47 AM | #65 |

|

Colonel

122

Rep 2,695

Posts |

Tenant's father! God bless the Second Amendment.

__________________

.-=[ Kenny ]=-. 1999 BMW M Coupe 10.775 @ 134.35 mph w/1.600 60' (Best 136.07 mph) 25th August 2004. +2010 X5 35D+

Check out the 1Addicts Drag Racing Standings and Drag Racing 101. |

|

Appreciate

0

|

| 03-05-2012, 07:58 AM | #66 |

|

Major

108

Rep 1,075

Posts |

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|